Company payroll tax calculator

2020 Federal income tax withholding calculation. GTM provides this free business payroll tax calculator and overtime calculator to help you find out what your employees taxes standard hourly rate of.

Payroll Deductions Calculator Stores 61 Off Aarav Co

SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

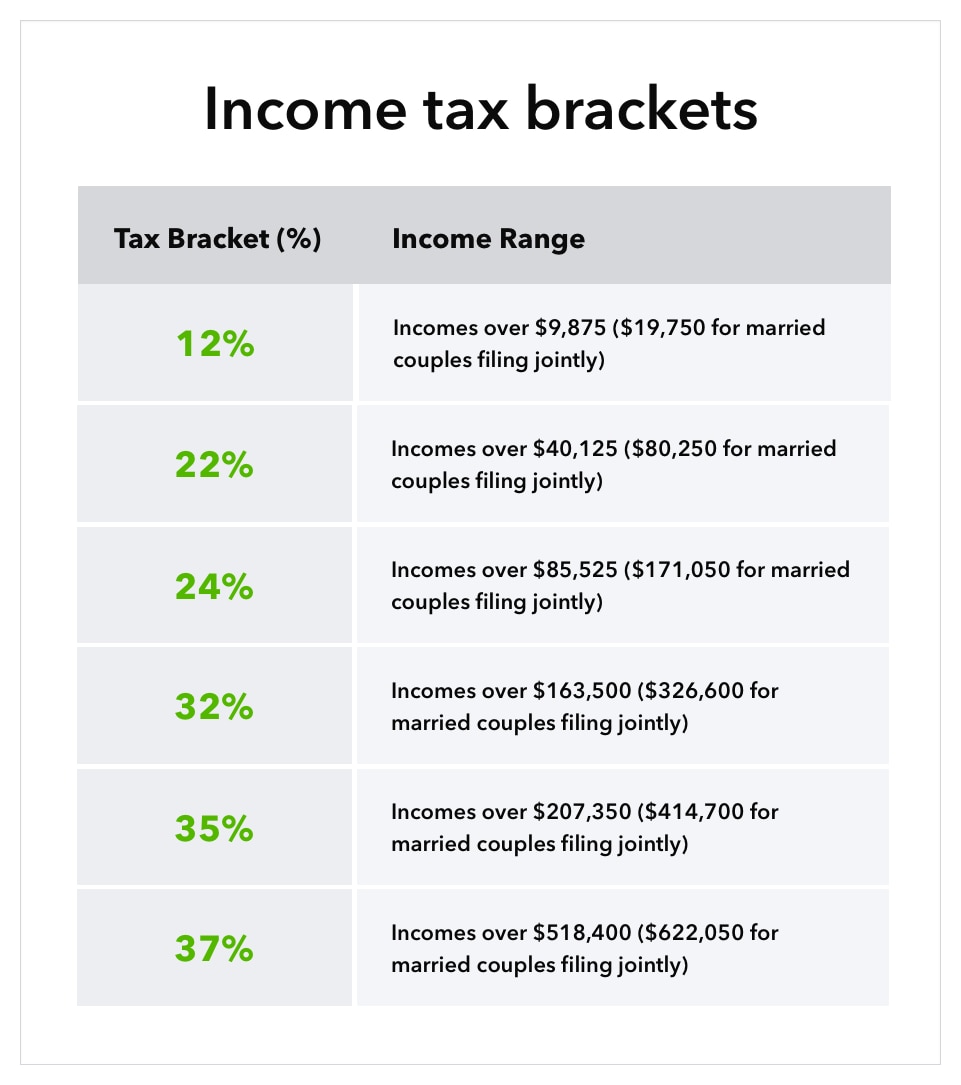

. Federal payroll tax rates for 2022 are. Both employers and employees are responsible for payroll taxes. Could be decreased due to state unemployment.

Business Payroll Tax Calculator. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. The standard FUTA tax rate is 6 so your max.

Get 3 Months Free Payroll. Make the hiring process more efficient by tracking all. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. For example if an employee earns 1500. 700 King Farm Blvd Suite 550 Rockville MD 20850.

The rates have gone up over time though the rate has been largely unchanged since 1992. Simplify the complex management of both employee benefits and business insurance with a single all-in-one provider. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

We calculate file and pay all federal state and local payroll taxes on your behalf. Medicare 145 of an employees annual salary 1. Ad Learn How To Make Payroll Checks With ADP Payroll.

Federal tax rates like income tax Social Security. This component of the Payroll tax is withheld and forms a revenue source for the Federal. Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2.

Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. Ad Compare This Years Top 5 Free Payroll Software. Calculate your liability for periodic annual and final returns and any unpaid tax interest UTI.

Ad See the Payroll Tools your competitors are already using - Start Now. Our online service is available anywhere anytime and includes unlimited customer support. Ad Compare This Years 10 Best Payroll Services Systems.

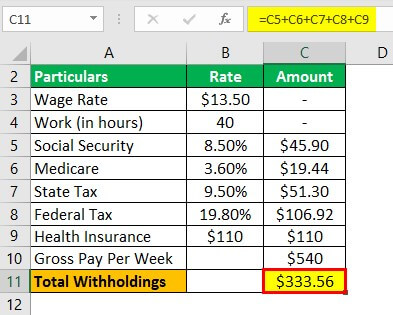

It comprises the following components. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to. This FREE business payroll tax calculator will help find out your employees taxes hourly rate of pay and their overtime hourly rate of pay.

Get 3 Months Free Payroll. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. Fast Easy Affordable Small Business Payroll By ADP.

Components of Payroll Tax. Free Unbiased Reviews Top Picks. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software.

Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your. The payroll tax rate reverted to 545 on 1 July 2022. Most employers use this paycheck calculator to calculate an employees wages for the current payroll period.

Enter your employees pay information. Free Unbiased Reviews Top Picks. Social Security tax rate.

Get 3 Months Free Payroll. Read In-Depth Reviews Here. If you want a.

Enter your info to see your take home pay. Subtract 12900 for Married otherwise. Online Payroll Tax Calculator.

GetApp has the Tools you need to stay ahead of the competition. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. This payroll tax calculator should be.

Ad Learn How To Make Payroll Checks With ADP Payroll. Find More Time to Focus on Whats Important to Your Business. Simplify Your Employee Reimbursement Processes.

2022 Federal State Payroll Tax Rates for Employers. Get 3 Months Free Payroll. Ad See How MT Payroll Services Can Help Streamline And Grow Your Business.

You can use our calculators to determine how much payroll tax you need to pay. Fast Easy Affordable Small Business Payroll By ADP. Learn More About Our Payroll Options.

How to calculate annual income.

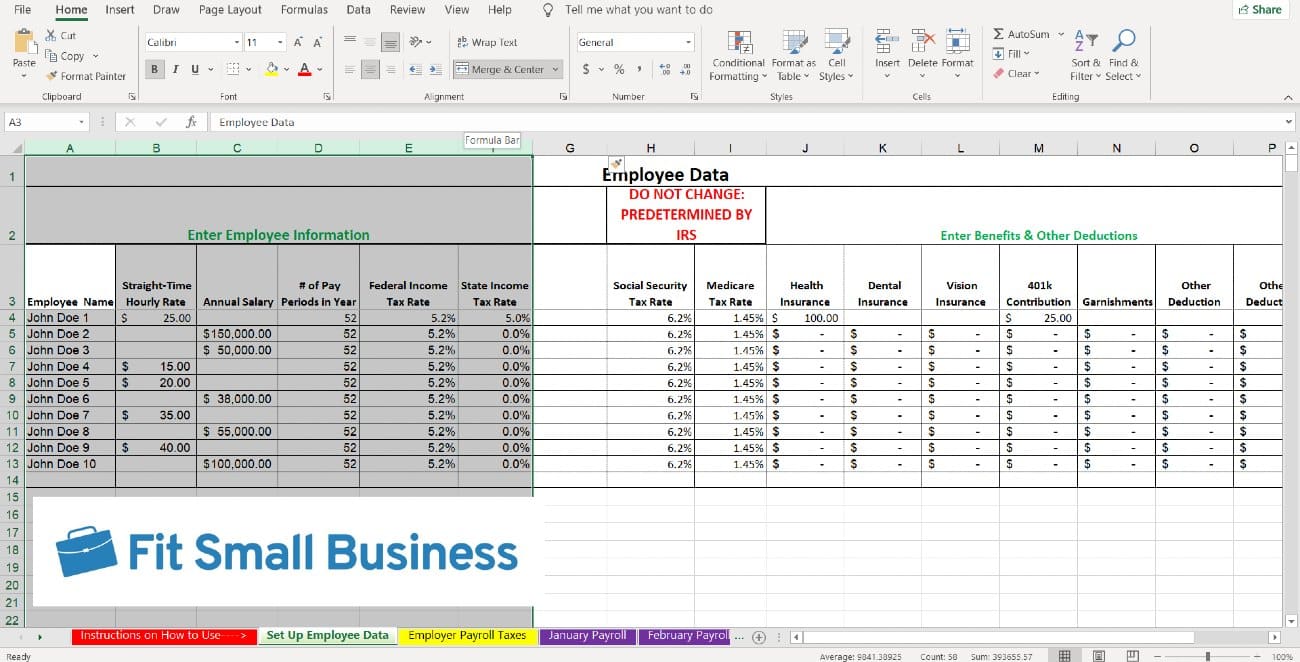

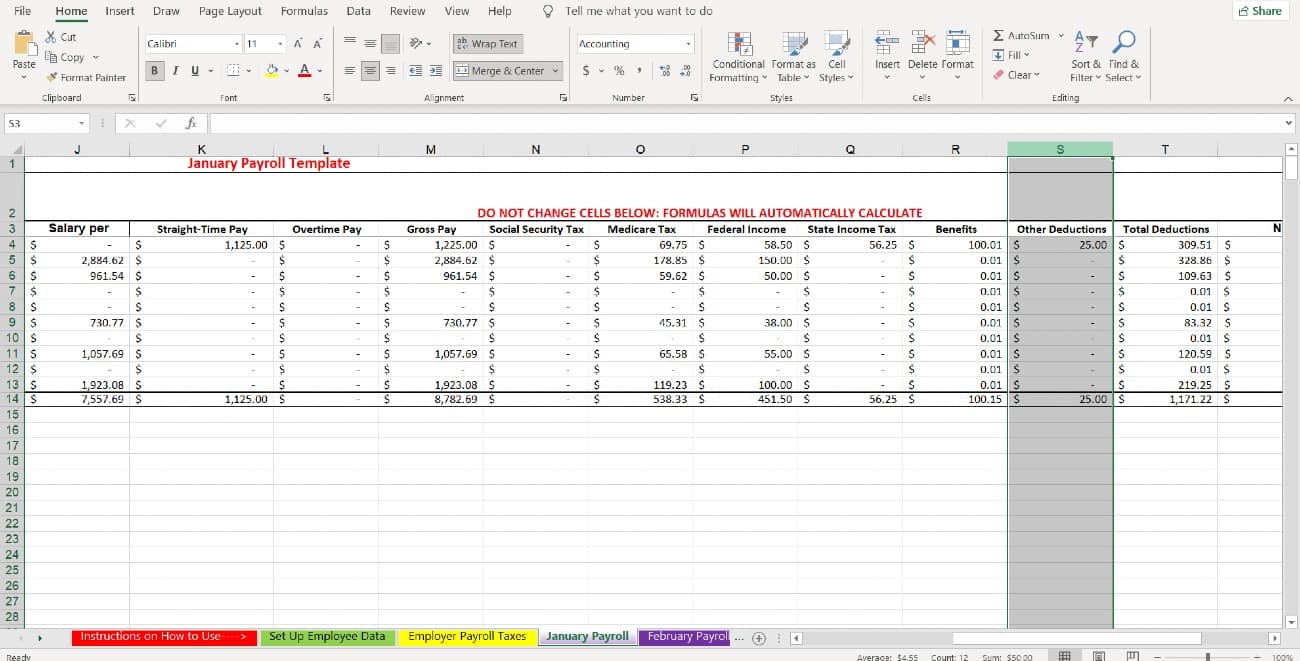

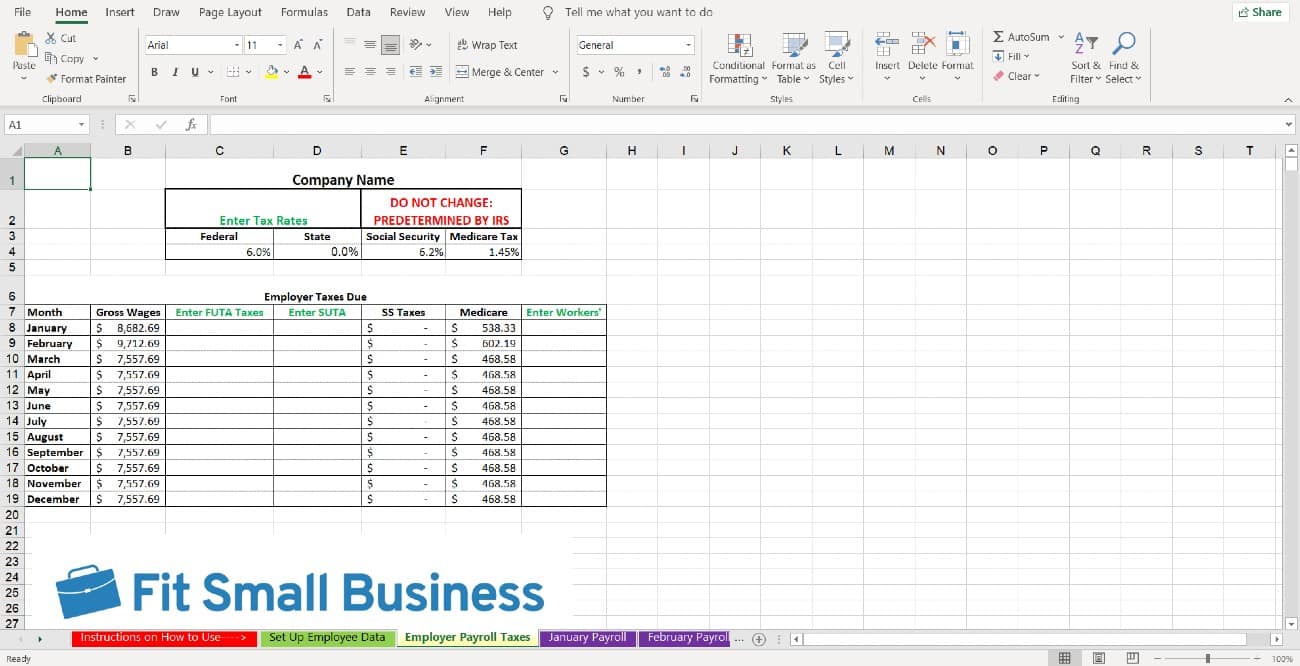

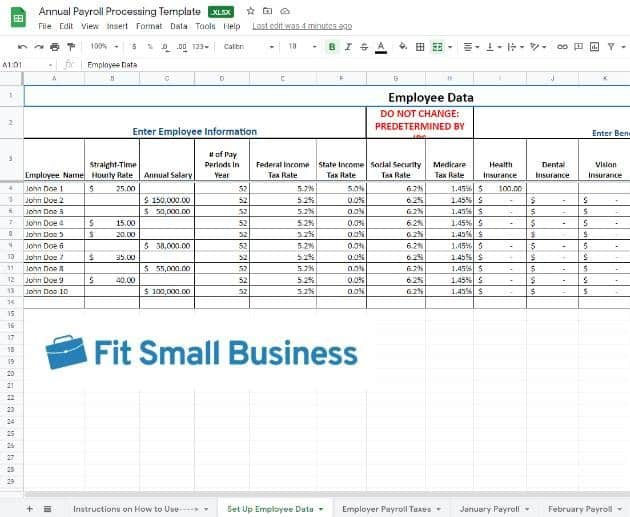

How To Do Payroll In Excel In 7 Steps Free Template

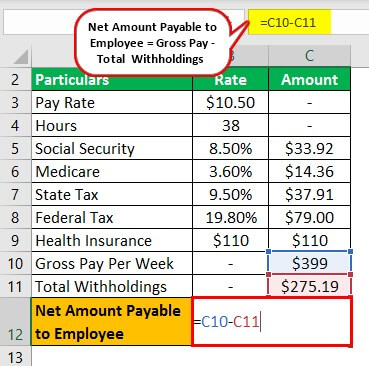

Payroll Formula Step By Step Calculation With Examples

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Do Payroll In Excel In 7 Steps Free Template

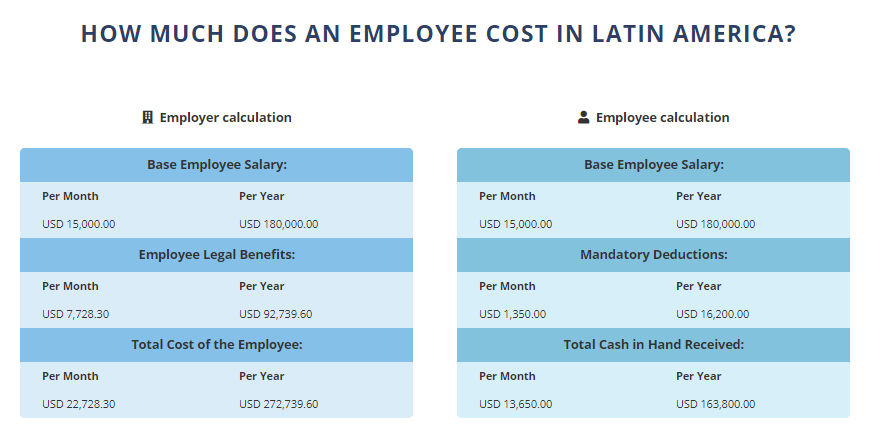

Hiring And International Peo Services Biz Latin Hub

How To Calculate Payroll Taxes Methods Examples More

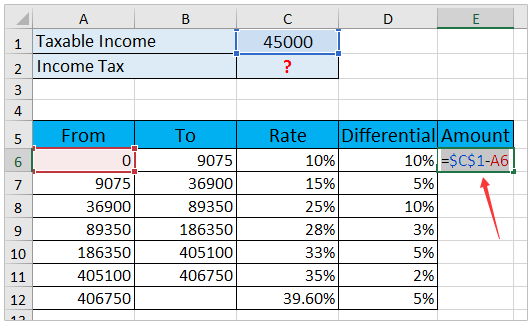

How To Calculate Income Tax In Excel

How To Do Payroll In Excel In 7 Steps Free Template

Understanding Payroll Taxes And Who Pays Them Smartasset

How To Calculate Income Tax In Excel

How To Do Payroll In Excel In 7 Steps Free Template

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Formula Step By Step Calculation With Examples